For those who have any type of extended-array fiscal purpose at heart, investing is likely to be required to achieve it. No matter whether the ideal is retirement life or sending a youngster to university, you might be greatest away from letting your money expand on its own after a while. Continue reading to find out some fundamentals about shelling out your money.

Before you start committing, consider supply from the market place and do your research on qualities. Have a look at between fifty plus a hundred or so qualities in your community of interest. Compare them making use of good notice getting along with a distributed page. Lease expectations, prices and fix spending budgets must be aspects you're contemplating. This will help you decide what deals work most effectively.

Marketing and advertising will likely be essential to your ability to succeed. Marketing and advertising is the thing that generates your qualified prospects. Without the need of sound prospects, you will not locate good deals on qualities. As a result, if one thing is not working in your expense plan, use your marketing strategy initial to view what is going on and what can be tweaked.

Talk to fellow real estate property brokers. It's important to get in touch with other individuals and obtain suggestions from individuals more knowledgeable than your self. Their understanding can keep you from producing errors and help save you some funds. You can find numerous others online. Get message boards to become lively on and discover events in your town.

You really should use a residence control service. This can cost you a tiny but will help a lot in the long run. These businesses can help you locate good renters, and in addition look after any injuries. This frees up time to look for far more properties.

Don't enter into real-estate making an investment except if you're capable to incorporate some backup money. Position dollars away to cover slight repairs. Another great reason for having additional money is just in case you can't look for a appropriate renter at the earliest opportunity. You will still require to think about the price of residence regardless of whether nobody is lifestyle there.

Try to find qualities which will be sought after. Truly quit and think about what most people will be seeking. Search for relatively valued components on peaceful roadways. Searches for properties with garages and several rooms. It's generally crucial that you consider exactly what the average person will probably be searching for in a home.

Standing is vital within the investing community. Consequently, generally tell the truth and do not make any adversaries. Most of all, follow through on which you say you are likely to do. If you are unclear if you can take action, do not have the assert in the first place. Your standing could experience and have an impact on your company for that reason.

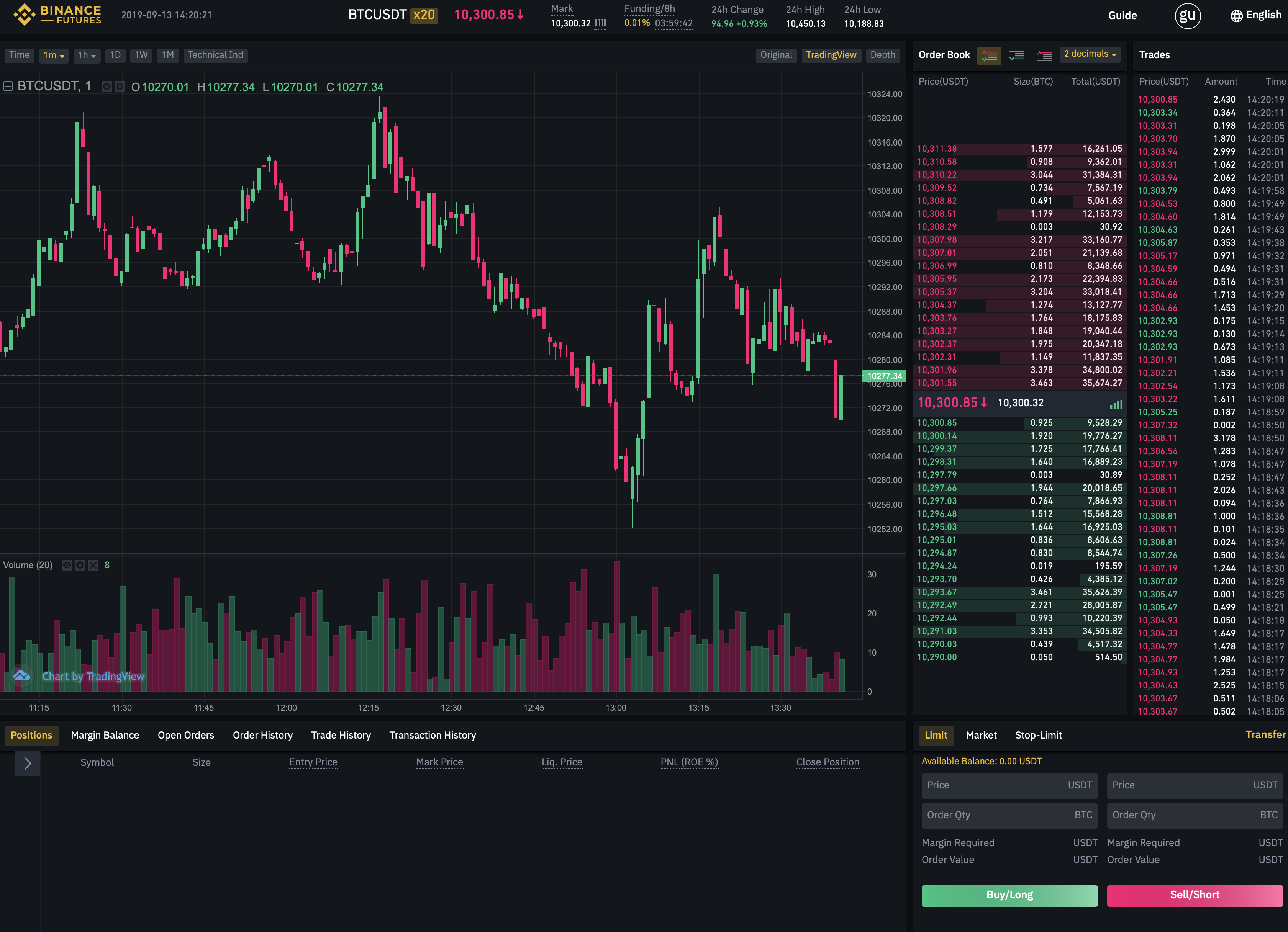

Can be your region experiencing a house worth increase? Can 바이낸스 선물 see openings where places are increasingly being hired? These are a couple of questions to ask yourself. You want to make sure you will find a requirement for rentals in your community that you buy.

Generally screen your renters. Being aware of who you are going to be leasing your properties to is important. Manage a background verify. Ensure they don't have a spotty and abnormal historical past with paying their lease promptly. Discovering relating to your tenant's history will save you lots of trouble afterwards.

Once you buy real-estate, take care not to over-devote. You happen to be better off commencing on the small scale than getting in over your head at the start. You don't wish to diminish your cost savings. Tend not to make it your full time work quickly. After you have been successful, it is possible to change your approach.

It's tempting to leap straight into the real estate market place, but that strategy can be quite dangerous. Somewhat, you need to start with small assets, then improvement to greater assets. In this way, you can expect to also have a monetary pillow and will not be wiped out by 1 misstep or streak of awful market place luck.

Watch out for any hoopla with regards to a a number of component of property. It makes no difference how very good the sales hype appears to be. It is perfectly up to you to definitely do detailed investigation in the piece of house to ensure that it is accurately displayed. Purchasing property based purely on buzz is definitely an imprudent choice.

Recurrent Online expenditure forums. You will are able to find out a great deal from individuals with many different encounter. You will get the chance to make inquiries from anyone who has been making an investment for many years. This type of investment community is generally rather supportive. New buyers often locate these groupings to get really useful.

Always be aware of hazards that you are currently dealing with. Normally, the higher the chance, the bigger the probable payoff will likely be. But in addition to that greater risk also is available a larger possibility of not creating any cash whatsoever. So evaluate the risk stage and ensure it is inside your comfort area.

Seek out ventures that provide taxes benefits. Based on the expense business, there can be a number of taxes advantages. Ties are a great illustration of a smart investment that be eye-catching as the gains to them could be income tax exempt. So element into individuals preserving when assessing the benefits that a business could have to suit your needs.

Keep the objectives practical. Don't rely on ventures allowing you to abundant. That's an extremely improbable result. Make your anticipations acceptable types. You can continue to make a great deal of money off from purchases, even should it be improbable to be a fortune. Congratulate yourself for tiny successes rather than permitting them to intimidate you.

In case you are making an investment in stocks and shares, then become knowledgeable about how precisely the pros and cons in the market are. Then when your stocks strike a "down" period, you will not be panicked and try to sell at a loss. Yanking your hard earned money out too rapidly is a type of blunder created by novice brokers.

At some stage in your way of life you are likely to think about a huge fiscal goal you wish to do from the significantly future. This can be setting up your nest ovum or giving a kid to a fantastic institution. You are able to take on such costly desired goals by shelling out cash after a while. Utilize the intelligence and ideas with this post to make your future dreams a developing reality.