When you have any sort of very long-array monetary target in your mind, investing is probably going to be necessary to do it. Regardless if the ideal is retirement or delivering a child to university, you happen to be greatest away from allowing your hard earned dollars grow itself with time. Continue reading to discover some fundamentals about shelling out your money.

Before starting shelling out, get supply of the industry and shop around on attributes. Examine between 50 as well as a hundred properties in the area useful. Do a comparison using good take note taking along with a distributed page. Rent payments objectives, rates and restoration finances should be factors you're contemplating. This will help make a decision what deals work most effectively.

Advertising and marketing will likely be vital to your ability to succeed. Advertising and marketing is really what generates your qualified prospects. Without strong qualified prospects, you will not get good deals on properties. Therefore, if some thing is not operating in your expenditure prepare, choose your online marketing strategy initial to discover what is going on and exactly what can be altered.

Speak to fellow real estate property traders. It's important to reach out to other individuals and acquire assistance from individuals more knowledgeable than your self. Their understanding can prevent you from producing blunders and save you some funds. You will find numerous others online. Locate forums to be active on and look for meetings in your neighborhood.

You might want to make use of a property managing support. This may cost a very little but will be very convenient in the long term. These businesses can help you find decent renters, and in addition look after any damage. This liberates up time to look for much more properties.

Don't get into property shelling out except when you're in a position to incorporate some support money. Position dollars besides to pay for small improvements. One other good reason for experiencing extra income is in the event you can't locate a perfect renter as quickly as possible. You still need to have to contemplate the expense of house even though no one is residing there.

Look for components which will be needed. Truly quit and think of what most people will probably be trying to find. Try to look for modestly costed attributes on calm roads. Actively seeks properties with garages and two or three bed rooms. It's always important to take into account what the common man or woman is going to be looking for at home.

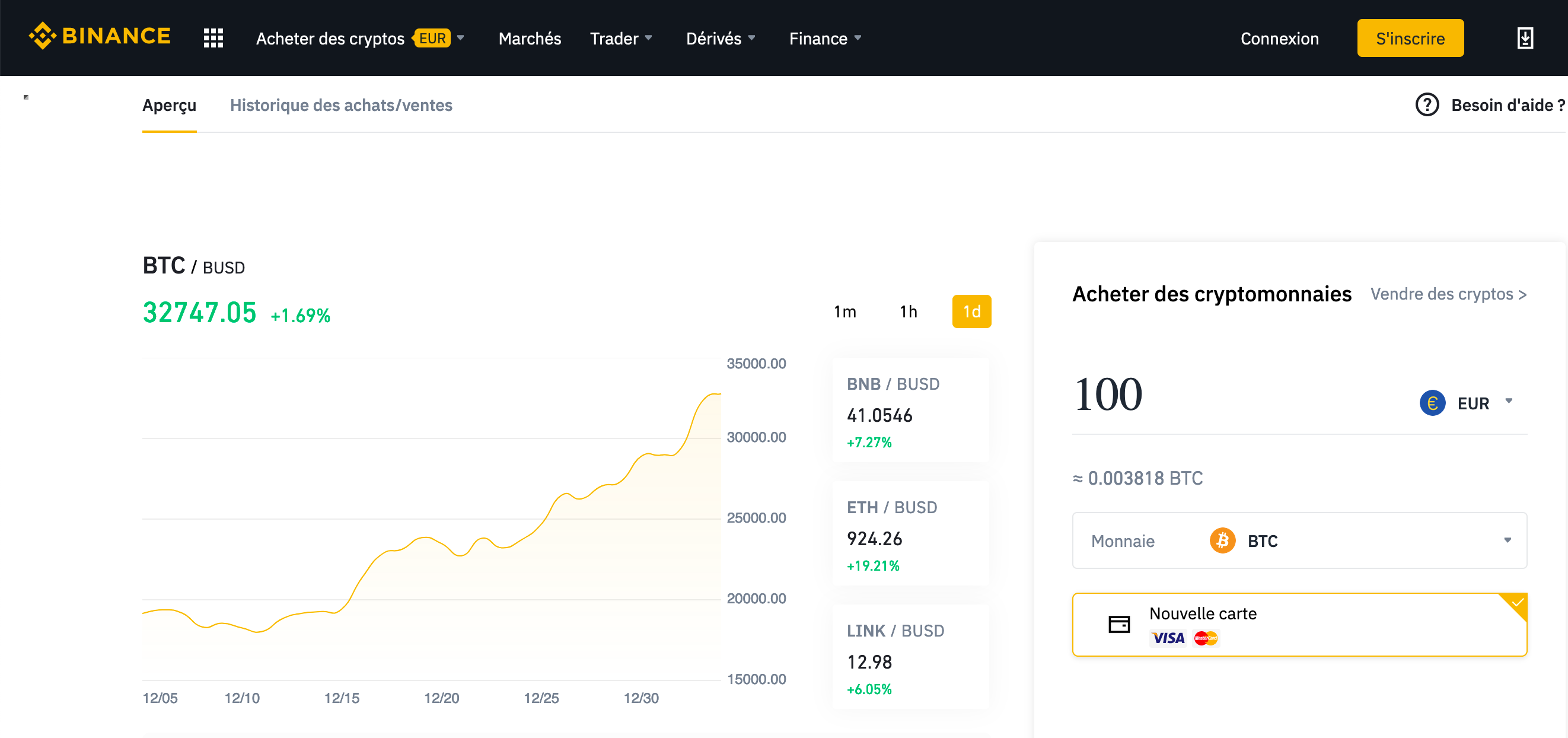

Status is important inside the making an investment community. For that reason, generally explain to the reality and try not to make any enemies. Above all, follow-through of what you say you might do. Should you be uncertain if you can take steps, will not make your state to begin with. 바이낸스 비트코인 could suffer and impact your small business for that reason.

Will be your region suffering from a property value improve? Can you see openings the location where the areas are increasingly being leased? These are some things to ask on your own. You need to make certain there exists a requirement for rentals in the community where you purchase.

Usually display your renters. Realizing who you will be renting your qualities to is essential. Operate a background examine. Make sure they don't use a spotty and abnormal historical past with spending their rent punctually. Discovering about your tenant's historical past can save you plenty of problems later on.

Once you acquire property, take care not to more than-spend. You are happier commencing on the small scale than getting into above the head at first. You don't want to diminish your savings. Do not make it your full-time work quickly. After you have been profitable, you are able to revise your technique.

It's luring to leap directly into the real estate market, but that strategy can be quite unsafe. Quite, you can start with modest investments, then development to greater assets. By doing this, you will also have a monetary pillow and will never be cleaned out by one misstep or streak of terrible market place good fortune.

Watch out for any buzz with regards to a particular part of property. It makes no difference how great the sales hype appears to be. It is up to anyone to do thorough investigation around the piece of residence to ensure it can be accurately symbolized. Purchasing property dependent solely on hoopla is undoubtedly an risky option.

Repeated Web investment forums. You may have the ability to learn quite a lot from these with plenty of experience. You will possess the chance to inquire from those who have been committing for a long time. This type of investment group is often rather accommodating. New traders typically get these teams being incredibly beneficial.

Generally are aware of the dangers you are handling. Normally, the better the threat, the bigger the potential payoff will probably be. But as well as that greater risk also will come a much bigger possibility of not creating any dollars whatsoever. So measure the risk level and ensure it is in your convenience area.

Seek out purchases that offer tax positive aspects. Based on the purchase venture, there could be certain tax advantages. Connections are an excellent demonstration of a smart investment that be appealing because the results about them might be taxes exempt. So factor into individuals conserving when assessing the benefits that the venture could have to suit your needs.

Make your requirements practical. Don't count on ventures making you abundant. That's a really unlikely final result. Keep your requirements affordable kinds. You can still make a great deal of dollars from assets, even should it be improbable to be a lot of money. Congratulate oneself for little successes as opposed to allowing them to dissuade you.

When you are purchasing stocks, then educate yourself about how the pros and cons of your market place are. When your stocks and shares success a "straight down" time, you will not be panicked and then try to sell at a loss. Tugging your hard earned dollars out too rapidly is a type of blunder created by amateur investors.

Sooner or later in your lifestyle you are likely to think about big monetary objective you wish to do from the significantly long term. This can be creating your home egg cell or delivering a kid to a wonderful college. It is possible to handle such expensive goals by investing cash with time. Take advantage of the knowledge and ideas of this post to create your upcoming ambitions a growing reality.